The Debt Traps

#1 Making minimum payments

Do you find yourself making minimum payments to your credit card debts every month but the total debt size is not decreasing? Well, this is because your monthly payment is only sufficient to pay off the interest accumulating from your credit card debt.

The average interest rate of credit cards in Singapore is about 25%, with some credit cards even charging up to 28% p.a.

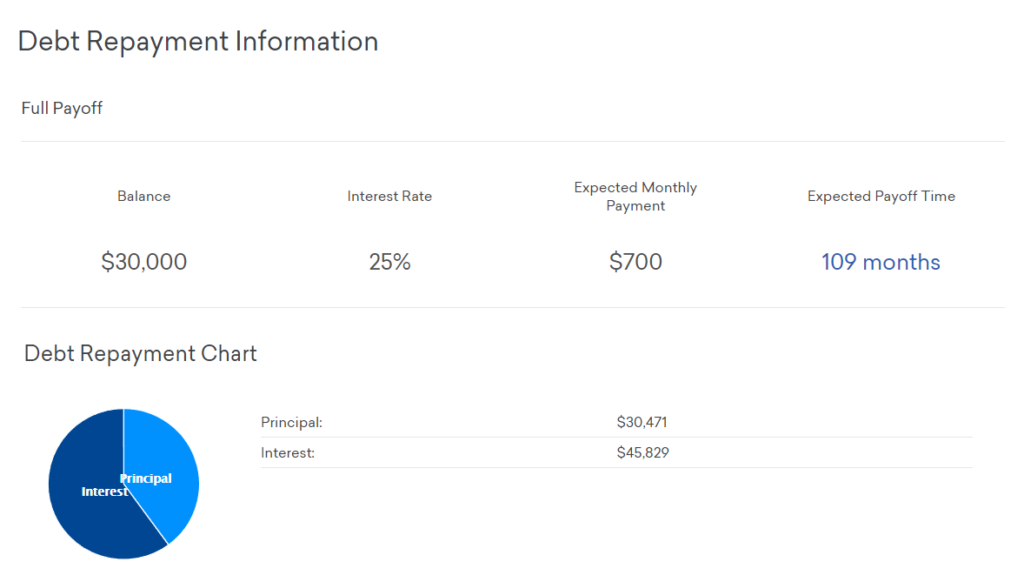

This means that with a credit card debt size of $30,000, you are paying about $625 in interest every month. Let’s take a look at our credit card repayment calculation below if you are making minimum payment of $700/month.

For your principal debt size of $30,471, it will take you 109 months (8 years and 1 month) to payoff your debt and the total interest incurred would be $45,829. This is assuming that you make payments punctually every month without defaulting any payment. This huge sum of interest is the main reason why most Singaporeans can’t seem to find themselves clearing their credit card debts and being stuck in this debt trap for a long time.

#2 Borrowing from a new creditor to pay off existing debts

If you find yourself unable to cope with the monthly repayments and constant harassment from creditors, you may find yourself borrowing a new loan to sustain the repayments from other creditors. What you get in return is few weeks of peace and less harassment but in fact, you are subjecting yourself to long term increased harassment from multiple creditors and more interest incurred.

Our client, Mr Mohammad, found himself in such a situation when he borrowed from a new moneylender every month to repay his current creditors. He started out with 1 moneylender loan of $2,000 and when he found himself unable to repay them monthly, he borrowed from a new moneylender every month. After 9 months, this led to a snowball effect with his debt snowballing to almost $18,000 with 11 moneylenders!

#3 Stop making payments entirely

This is the most dangerous situation to put yourself in as you would be exposing yourself to heaps of interest accumulated and bankruptcy. With the ongoing interest rate of 25% p.a. for credit cards, you will see your debt increasing from $30,000 to $60,000 in only 3 years! When you default payments for a long period of time, your creditors can also sue you for bankruptcy to retrieve the debts. When this happens, you will be issued a Writ of Seizure and Sale whereby your creditors will be able to seize your assets and properties, including the items in your home, to repay the monies owed.

Do you find yourself stuck in any of the above situations? Are you unable to repay the monthly repayments to your creditors? Contact us to find out how we can help you get out of these debt traps with our government-initiated schemes.